To the editor:

I’m sure someone along the way has said that a half truth is more dangerous than an outright lie. Therefore, I would like to offer the following to counter a half truth told and retold by Rep. Jacobs.

During his presentation at the March29 meeting, Jacobs stated on several occasions that his tax bill would be 25 percent lower if he lived in the city of Dunwoody rather than unincorporated DeKalb County.

However, what Rep. Jacobs failed to tell us is that the very appealing 25 percent tax savings was only for taxes totaling less than 10 percent of his total tax bill – that portion billed directly by the city of Dunwoody. If Jacobs were to compare the savings on his total tax bill, the savings for living in the city of Dunwoody would shrink dramatically to less than 2 percent.

Why such a discrepancy?

The total 2010 property tax bill for the city of Dunwoody is based on a millage rate of 39.330 mills (with 1 mill equaling $1 in taxes for each $1,000 of assessed property value). Of the 39.330 total mills paid by the residents of the city of Dunwoody, 13.16 mills (33 percent) are paid to DeKalb County for bonds, hospital and fire service, 22.96 mills (59 percent) are paid to DeKalb County schools, 0.25 mills (1 percent) are paid to the state of Georgia for bonds and the remaining 2.74 mills (7 percent) are paid to the city of Dunwoody for the services it provides.

For residents in unincorporated DeKalb County, the 2.74 mills for Dunwoody services is replaced by a 3.50 mills charge for similar DeKalb County services. The total 2010 property tax bill for residents in unincorporated DeKalb County is 40.090 mils. Comparing the total tax bills, the total overall property tax savings for the residents living in the city of Dunwoody is less than 2 percent.

Yes, if we compare only the 7 percent of the total tax bill that pays for city versus county services and forget about the remaining 93 percent of the bill, we can say there is a 22 percent tax savings for those who live in the city of Dunwoody.

However, we must realize that the tax amount billed under the first two millage categories noted above, totaling 92 percent of the total tax bill for the residents of the city of Dunwoody, is and will continue to be controlled by DeKalb County. And yes, if you become a resident of Dunwoody or Chamblee or Brookhaven, the $150,000 salaried staff member we all got a good chuckle about will still be on your “payroll” as his position is included in the 92 percent of tax dollars going to DeKalb County. It becomes glaringly obvious that the idea of cityhood, while appealing, is only a band-aid cure on a cancer that will continue to eat away at our wallets.

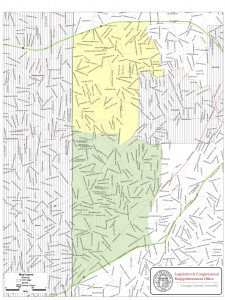

Therefore, whether you live in the yellow annexation area or the green city area shown on Rep. Jacobs’ map, serious consideration and effort must be given to what can be done to change the underlying problems within DeKalb County government. Unless we can force substantive changes in how DeKalb County spends our tax dollars, we will never realize the tax savings Rep. Jacobs so gleefully dangles in front of us as an underlying incentive for his city movement.

Jim Eyre